Sweden is facing a mild recession.

The major forecasters agree on this. The government, the Norwegian Economic Institute and the Riksbank all believe in growth next year and unemployment rising only moderately.

– If we succeed in a certain cooling, we are close to what economists call a soft landing of the economy, explained Riksbank Governor Erik Thedéen this week.

Soft landing. Worldwide is the word on the lips of economic analysts. Even in Sweden, which stands out with a clear decline right now, hope is still alive.

At the same time, the hard landing is already a fact in parts of the Swedish economy.

Take the wood industry.

Småland’s Anebyhus opened its first factory in 1945 and flourished during the record years. In recent decades, the wooden house industry has had several near-death experiences.

But it was the pandemic, the inflation crisis and the subsequent interest rate shock that finally put an end to the saga of Anebyhus. In August, the company, until recently the country’s fourth largest house manufacturer, filed for bankruptcy.

Klas Holm worked for over 24 years in the company and has been in the construction industry longer than that.

– At the beginning of 2022, it was felt that now we have to pull the handbrake. Already after the summer, the first warning came. After the turn of the year, we ended up in reconstruction. Let’s hope there are some house companies left in the country when this is over. It is worse than the 90s crisis, he says.

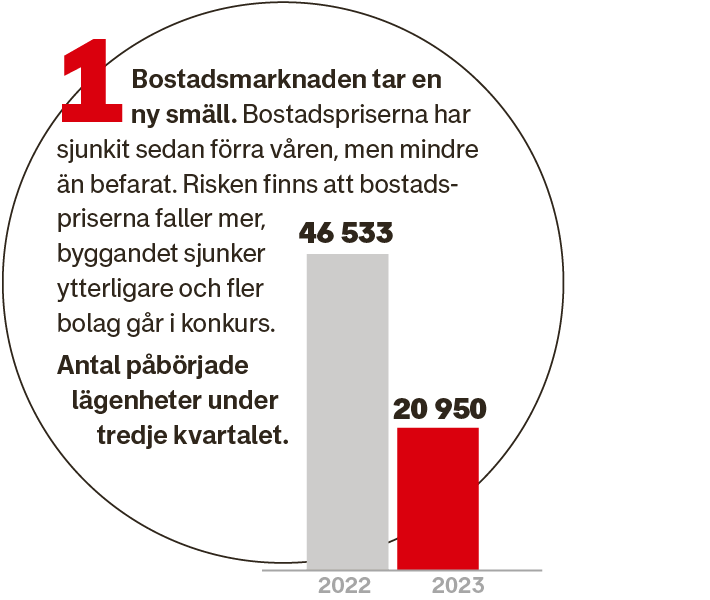

Within a year housing construction in Sweden has more than halved.

It is not an insignificant matter. In a typical year, housing investment accounts for upwards of 5 percent of our gross national product.

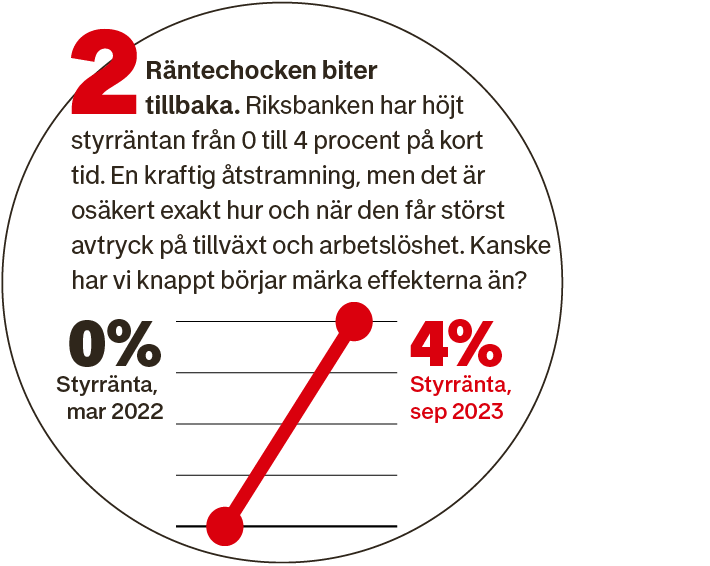

Behind the decline are rampant costs and rising interest rates. In just over two years, consumer prices in Sweden have risen by 20 percent. At the same time, the policy rate has been raised from 0 to 4 percent.

Erik Öberg is a lecturer in economics at Uppsala University and researches monetary policy.

– We have had a significant austerity in the Swedish economy. But what you have to think about is that monetary policy has an effect through different channels, with different delays, he says.

A channel is folks interest payments. For Swedish households, with large and variable mortgages, the increases bite quickly. For over a year now, Swedes have gradually reduced their consumption.

But higher policy rates also spread in other ways, working their way through the financial markets and leaving traces in investment calculations and employment plans. That process is not completed in an afternoon.

– The clear effects on growth and unemployment usually come with a delay of one, two, up to three years. I think we will see the consequences of the Riksbank’s interest rate increases over the next two years.

Pitfall 2

Erik Öberg points out that real interest rates, i.e. interest rates adjusted for inflation, are of great importance to companies. And they are rising now.

– If we keep the key interest rate at the same time as inflation goes down, then monetary policy will be tighter without the Riksbank making any new decisions, he says.

The Swedish economy thus has a lot left to absorb from the bitter interest medicine.

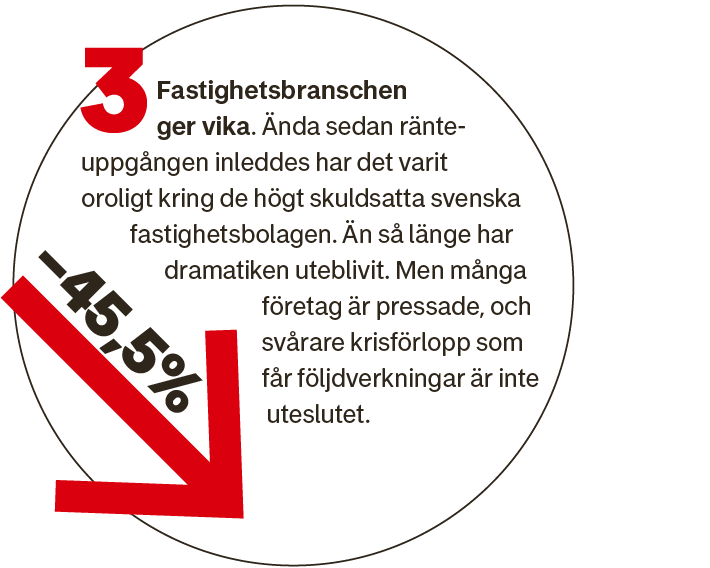

Pitfall 3

The commercial real estate companies is an example of that. Here, too, interest rate increases bite quickly. The concern is strong around several large landlords.

– But there will be more.

That’s what Maria Gillholm, real estate analyst at the credit rating institute Moody’s says. She follows a deeply indebted industry. Sweden has the most vulnerable population in Europe, she says.

– During the pandemic, when the central banks pushed for lots of cheap capital, Swedish real estate companies borrowed large amounts on the bond market. But now we have three years when those loans expire. A wall of loans. It is the Achilles heel of the Swedish real estate sector.

“We believe that the banks can take care of this increased need for loans. The Swedish banks will be picky and make demands, and the real estate companies need to live up to those demands in order to get financing”

Swedish authorities have long warned of the risks. The concern has been that losses will spread, cause the banks to wobble and, in the long run, drag down the entire social economy.

Maria Gillholm picks out a diagram that resembles a bowl of noodles. This shows the cross-ownership between the Swedish real estate companies.

– Everything is linked. Problems can create domino effects.

Despite that, Moody’s believes in just a soft landing in the industry.

– We believe that the banks can take care of this increased need for loans. The Swedish banks will be picky and make demands, and the real estate companies need to live up to those demands in order to get financing, says Maria Gillholm.

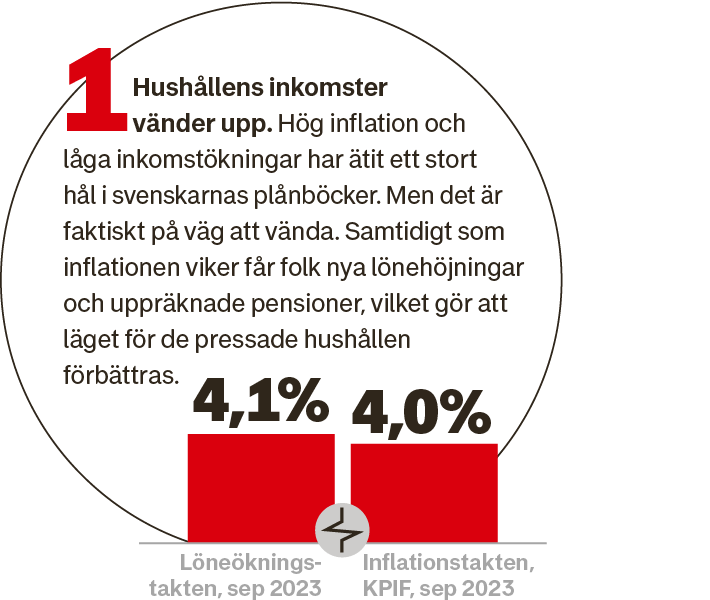

For Swedish economy is the way towards a mild recession not only fringed with risks. With inflation now falling, household finances are slowly starting to heal. Consumption may recover.

Lifeline 1

There is a striking resilience, says Annika Sundén, former analysis director at Arbetsförmedlingen.

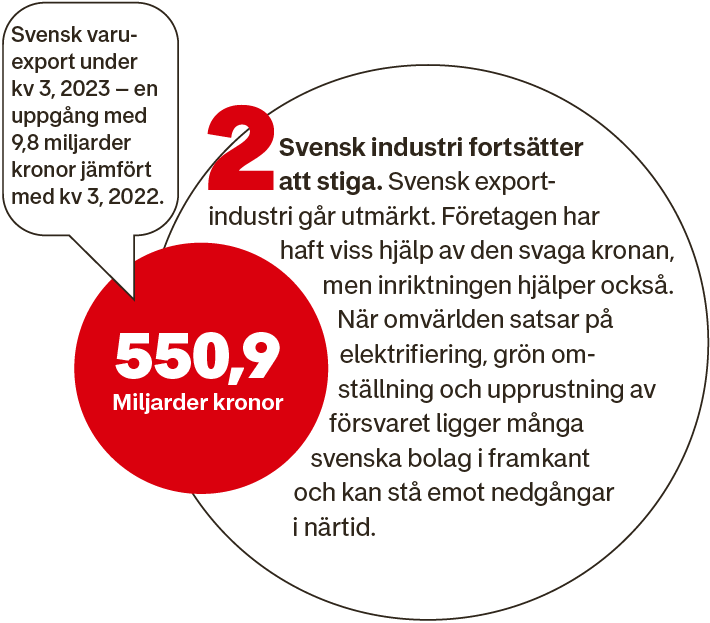

– Construction and the real estate industry are certainly important to Sweden, but they are not as important as the export industry. That it continues to go so well speaks for a soft landing. Now we see tendencies towards an increase in unemployment, but it is nothing dramatic.

– If we look ahead, there are no major negative signs in the warning figures, says Annika Sundén.

Lifeline 2

At the state Institute of Economics we are now sketching the year’s last major macro forecast.

International Monetary Fund economists have shown that forecasters often miss the fact that they are facing a major downturn. And once the downturn is evident, it is common for forecasts to incorrectly show a soft landing.

Ylva Hedén Westerdahl is head of forecasting at the Norwegian Economic Institute.

– We don’t put in soft landings on the idle, but always try to make the best forecast we can. The problem when you have a sharp decline is that it is usually caused by something big and unexpected happening. Such is genuinely difficult to forecast.