Update: 2/05/2024 15:50

Issued by: 2/05/2024, 2:33 p.m

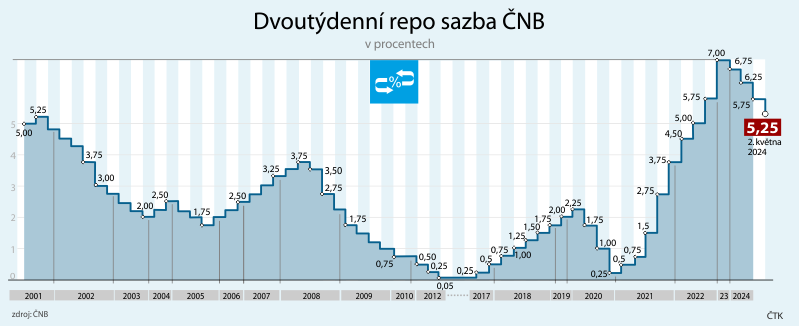

Prague – The Banking Council of the Czech National Bank (ČNB) today reduced the base interest rate by half a percentage point to 5.25 percent. Jakub Holas, director of the CNB’s communications department, informed about it. The base interest rate thus reached its lowest level since the beginning of May 2022. Most analysts expected a rate drop in this range.

The press conference of the bank board will take place at 15:45. CNB Governor Aleš Michl will explain the reasons for today’s decision. He will also present the central bank’s new macroeconomic forecast, which the members of the banking board relied on when deciding on the setting of rates.

Interest rates on bank deposits and loans depend on central bank rates. Higher interest rates bring more expensive loans for investments and operations to businesses, and more expensive housing loans to households. At the same time, however, with higher interest rates, the appreciation of deposits on accounts increases.

In addition to the base interest rate, the Bank Board reduced the Lombard and discount interest rates to the same extent. The Lombard rate, at which commercial banks can borrow money from the central bank against securities, is now 6.25 percent. The discount rate, to which, for example, penalties for defaulted loans are linked, fell to 4.25 percent.

The CNB started the decline in interest rates last December, when in the first step it lowered the base interest rate by a quarter of a percentage point to 6.75 percent. Before that, rates were unchanged at seven percent for a year and a half. In February of this year, the CNB accelerated its rate reduction, when it went for a decrease of half a percentage point, and repeated the same step at the March meeting.

Analysts: The markets expected the CNB’s decision to cut the base rate by half a point

Today’s decision of the Czech National Bank (ČNB) to reduce the base interest rate by half a percentage point was in line with market expectations and thus does not represent a big surprise. Analysts contacted by ČTK agreed on this. According to them, the zero reaction of the financial market also corresponds to this.

The immediate reaction on the financial market is minimal when the koruna hovers near CZK 25.10/EUR, where it has strengthened in recent days, Raiffeisenbank analyst Martin Kron told ČTK. The two-week repo rate has reached the level of the lower limit of the interest rate range of the American central bank Fed, pointed out XTB analyst Tomáš Cverna. According to him, the koruna can be expected to weaken against the dollar if the CNB continues to cut rates.

“Today’s reduction in CNB interest rates is completely in line with the expectations of the analytical community,” Generali Investments analyst Radomír Jáč said. According to him, the reduction of interest rates by half a percentage point may lead to a slightly negative reaction of the exchange rate of the koruna. It can be assumed that the CNB will also reduce interest rates at the next meetings, which will lead to a decrease in domestic banks’ interest rates, both for deposits and loans, he added.

Traditionally, today’s decision will have the fastest impact on the market for those products whose interest rates are most closely linked to the CNB’s short-term rate, added Czech Banking Association analyst Jakub Seidler. He thus expects a further drop in interest rates for corporate loans. According to him, the rates for deposits will also decrease in line with the decrease in the main rate of the CNB.

According to him, the decision may not have any noticeable effect on mortgage rates. “However, this information is already contained in the longer rates, and on the one hand, these rates have been significantly affected in recent weeks by global developments and, in particular, by the reassessment of market expectations regarding the rate of decline in rates by the American central bank, the Fed,” noted Seidler.

“Due to the increase in the price of resources, banks will be cautious and rather keep their mortgage rates at the current level, for three and five-year fixations. If banks lower mortgage rates, then for short fixations of one to two years,” the mortgage specialist added FinGO Jana Vaisová.

According to Cyrrus analyst Vít Hradil, the debate was between lowering the base rate by 0.50 and 0.25 percentage points. According to him, the Czech consumer inflation, which in the past two months reached the central bank’s two percent target, spoke in favor of a bolder approach, which would entitle the CNB to cut rates even steeper. On the other hand, caution is encouraged by the more detailed structure of inflation, which shows that this goal was achieved to a large extent with the help of the statistical effects of last year’s comparative base, he noted.

Given the drop in inflation and the return of year-on-year growth in consumer prices in the first quarter to normal values, further reductions in interest rates make sense, said Bohuslav Čížek from the Union of Industry. High interest rates, and therefore more robust financing costs, represent another obstacle for companies in growth or investment planning, he believes. According to him, the reduction of the interest burden is therefore beneficial from the point of view of business activity.

According to Komerční banka analyst Martin Gürtler, the Banking Council will also reduce interest rates at the same pace in the next two meetings. For June and August, he expects a decrease of half a percentage point again. Total and core inflation should remain within the CNB’s tolerance zone until the end of the year, he estimated.

The CNB has improved the outlook for the economy, expecting GDP growth of 1.4 percent this year

The Czech National Bank has improved the outlook for the development of the domestic economy. Gross domestic product (GDP) will grow by 1.4 percent this year, while the CNB’s February forecast expected growth of 0.6 percent. The CNB reduced this year’s inflation estimate to 2.3 percent from February’s 2.6 percent. CNB Governor Aleš Michl presented the new macroeconomic forecast to journalists today.

According to the preliminary estimate of the Czech Statistical Office (ČSÚ), the Czech economy grew by 0.4 percent year-on-year in the first quarter of this year. The CNB forecast predicts faster economic growth next year. There, the central bank also upgraded the outlook, now projecting GDP growth of 2.7 percent, compared to 2.4 percent expected in February.

Inflationary pressures in the economy are fading, this year’s inflation should decrease to 2.3 percent from last year’s 10.7 percent, according to the forecast. For next year, the CNB kept its February estimate, when it still expects consumer prices to grow at its two percent target for the whole year.